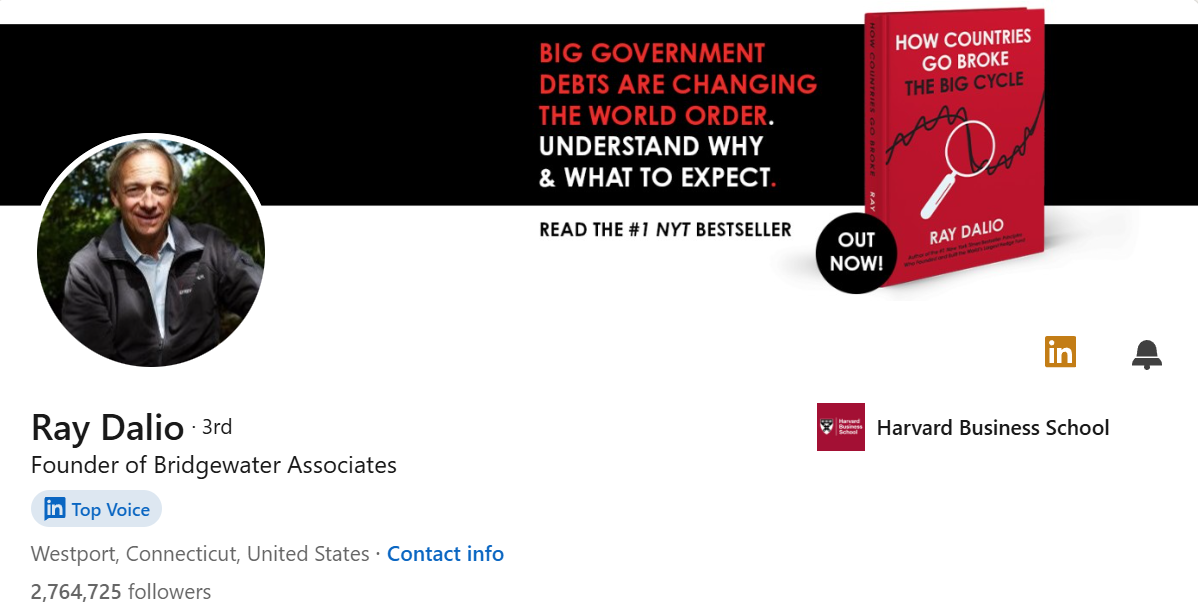

LinkedIn Voices: Ray Dalio

A towering figure in the world of finance, Ray Dalio is more than just a billionaire investor; he is the founder of the world's largest hedge fund and a philosopher of life and work. His journey from an aspiring Wall Street trader to one of the most influential minds in modern economics is a testament to his relentless pursuit of a principles-based life.

Ray Dalio: The Man Behind the World's Largest Hedge Fund

Ray Dalio is a name synonymous with modern finance and a unique approach to management. Born in Queens, New York, in 1949, he started his journey to becoming a billionaire investor at just 12 years old, caddying for golfers and using his earnings to buy his first stock.

This early passion for the markets, combined with a degree in finance and an MBA from Harvard Business School, laid the groundwork for his future success.

In 1975, Dalio founded Bridgewater Associates from his two-bedroom apartment. What began as a small advisory firm grew into a financial powerhouse, eventually becoming the largest hedge fund in the world. Dalio's vision and unconventional methods were instrumental in this growth, setting him apart from his Wall Street peers.

The Philosophy of Principles

What truly defines Ray Dalio is his emphasis on "principles." He believes that having a set of clear, logical principles is the key to navigating life and work successfully. He has documented these philosophies in his best-selling book, Principles: Life & Work, which has been widely adopted by business leaders and individuals alike.

Two core concepts from his philosophy are "radical transparency" and "an idea meritocracy". Radical transparency encourages open and honest feedback, where individuals are expected to speak their minds and critique ideas, regardless of their position. An idea meritocracy is a culture where the best ideas prevail based on their merits, not on who proposed them.

Metrics & Impact

Platform Reach: Bestselling author of Principles with millions of copies sold worldwide; massive global following across social media (LinkedIn 3M+, Twitter 700K+).

Client Base / Influence: Advisor to governments, central banks, and global institutions; founder of Bridgewater Associates, the world’s largest hedge fund (managing over $150B in assets at peak).

Funding / Wealth Creation: Personally built a multibillion-dollar enterprise; net worth estimated at ~$16B (Forbes, 2025).

Growth & Legacy: Transformed Bridgewater from a small apartment-run firm in 1975 to a global powerhouse, pioneering risk-parity strategies and principles-based decision making.

Content Strategy on LinkedIn

Ray Dalio has over 2 million followers on LinkedIn, making him one of the most influential voices in finance and leadership on the platform. To engage such a massive audience, he uses a content strategy that blends economic insights with timeless principles and a practical teaching style.

Macro Insights & Market Trends

Break down global economic shifts (inflation, interest rates, debt cycles) into digestible posts.

Use charts, visuals, and analogies to simplify complex ideas.

Principles & Frameworks

Share snippets from Principles and other writings, framed as practical takeaways.

Use storytelling to connect abstract principles to real-world scenarios.

Leadership & Decision-Making

Reflect on decades of running Bridgewater: lessons on culture, radical transparency, and managing people.

Short-form “decision frameworks” (e.g., how to handle conflict, risk, uncertainty).

Timely Commentary

React to current economic or geopolitical events with short, principle-driven insights.

Position posts as “here’s how I think about this” rather than predictions.

Personal Angle

Occasional reflections on philanthropy, meditation, and life lessons.

Humanizes the brand and broadens reach beyond finance.

Examples of his Featured Posts on LinkedIn

Ray Dalio's LinkedIn Account:

Why He Matters

Ray Dalio is one of the most influential investors and thinkers in modern finance. Beyond founding Bridgewater Associates, he’s shaped global economic thought with his frameworks on debt cycles, markets, and leadership. His writings, especially Principles, extend his impact far beyond investing, influencing entrepreneurs, policymakers, and business leaders worldwide.

Some of His Talks

Quick Profile Summary

Info | Detail |

Name | Ray Dalio |

Title | Founder of Bridgewater Associates | Author of Principles |

Focus | Global Macro Investing, Economic Cycles, Principles-Based Leadership |

Experience | Legendary investor; built Bridgewater into the world’s largest hedge fund ($150B+ AUM); advisor to governments, central banks, and global institutions |

Funding / Wealth | Built a multibillion-dollar enterprise; personal net worth ~$16B (Forbes 2025) |

Platform Reach | Author of Principles (millions sold); 3M+ followers on LinkedIn; 700K+ on Twitter/X |

Client Base / Influence | Advisor to policymakers, Fortune 500 leaders, and institutional investors worldwide |

Notable Achievements | - Pioneered risk-parity strategy- Authored Principles, Big Debt Crises, The Changing World Order- Recognized as one of the most influential thinkers in finance and leadership |

Website |

_